Biometrics Market to Hit $50 Billion by 2024

High acceptance among various verticals including mobile banking and financial services owing to rising security concerns has enhanced biometrics market size.

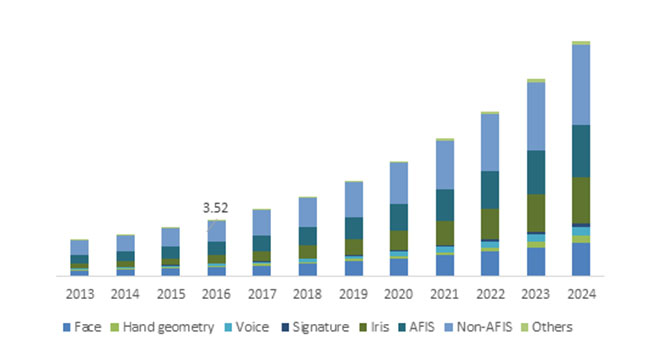

Biometrics Market size is estimated to surpass USD 50 billion by 2024; according to a new research report by Global Market Insights, Inc. High acceptance among various verticals including mobile banking and financial services owing to rising security concerns has enhanced biometrics market size. Government initiatives for biometrics implementation coupled with high deployment for criminal identification will remain the key factors driving industry demand.

Industry players focus on technological advancements and new product launches to cater to the customer requirements. Benefits offered including provision of precise and accurate validation as compared to traditional validation methods such as PINs and ID cards, are anticipated to increase the industry penetration across the globe till 2024.

Increased smartphone penetration coupled with expansion of consumer electronics will favor the biometrics market share over the forecast timeframe. In addition, rising investment in military & defense due to authentication concerns is anticipated to offer high growth potential. Multimodal biometrics system is an emerging trend in public and private work space for stringent attendance recording purposes. However, high implementation cost and stored data uncertainty may hamper industry growth over the forecast timeframe.

U.S. Biometrics Market Size, By Product, 2013-2024 (USD Billion)

Non-AFIS will account for the highest biometrics market share, surpassing USD 18 billion till 2024. This can be attributed to its high usage in various applications which include cashless vending and workforce management. Moreover, it finds use in various public areas that assure keyless entry and efficient security. Iris recognition will exhibit over 20 percent CAGR owing to wide integration of iris scanners mainly in smartphones.

Benefits such as unauthorized vehicle use detection, reduction of overtime expenses, and identification of billing anomalies will support the transportation & logistics segment growth from 2017 to 2024. Banking & finance applications will benefit from the rising demand from various financial institutions for precise authentication and streamlining of operations.

North America biometrics market is expected to account for more than 30 percent share till 2024. Rising demand from government & security sector in U.S. coupled with the presence of major industry participants will escalate the industry growth. Moreover, favorable regulatory landscape in the U.S will help in fostering the industry demand. Asia Pacific is poised to grow at the highest CAGR owing to various government initiatives in the countries including China and India. National enrollment program (UIDAI Aadhar) in India, and China Resident Identity Card (CRIC) are among the implementation examples across the region.

Global industry share is highly fragmented with various participants across the globe. BIO Key International, David Link, EyeVerfiy, Iris ID, and NEC Corporation are among the prominent players in the biometrics market. Other notable players include Lockheed Martin, Green Bit Biometric Systems, FaceFirst, ZKTeco, and 3M Cogent.

Industry players focus on adoption of strategies including strategic alliances and partnerships to strengthen their position. For instance, in July 2017, Iris ID entered into a strategic partnership with Tongrentang for high revenue generation.