Online Exclusive: Banking on Video Intelligence

Today’s financial institutions are working faster and smarter with video-based software applications designed for speed and return on investment.

Video surveillance technology has evolved dramatically during the past five years, but a paradigm shift with game changing consequences for banks and credit unions is only now truly underway.

Intelligent video surveillance applications are markedly reducing the time it takes to conduct investigations, gather indisputable case evidence and ultimately cut losses from fraudulent transactions at ATMs and teller stations. They are helping financial institutions safeguard their assets more effectively, and even take advantage of integrated video analytics to improve customer service and marketing efforts.

What’s most compelling about these video-based software applications is that they build on the surveillance and transaction data systems already in place in most financial institutions today – leaving organizations free to upgrade to new capabilities without sacrificing their existing technology investments.

Improve Investigations, Case Management, Compliance Audits

Imagine that your bank confirms a fraudulent transaction at one of your teller stations or ATMs. With intelligent video applications, an investigator can simply enter the stolen bank card number into the system, and then click through to view brief video clips of every associated transaction from anywhere across their entire retail banking network. With one click of the mouse, they can then easily export that integrated case evidence to a disk or USB for law enforcement, dramatically increasing the productivity of the investigation team and the quality of evidence.

Through centralized searches on correlated data (which can include surveillance video, transaction data, license plate numbers, colors and facial images), banks and credit unions are able to extract critical information from their systems quickly and easily – eliminating the need to wade through hours of recorded video or travel to multiple branches to physically pull footage. By cutting the time required to gather and package case evidence, these intelligent applications leave investigators free to review more suspect incidents, often with lower case values.

In addition, intelligent video makes it much easier for banks and credit unions to audit key processes to ensure compliance. Many financial institutions require a manager’s signature when customers cash checks for more than $1,000, for example. Easy-to-use software makes reviewing such transactions a simple process; allowing managers to quickly confirm compliance or identify where further enforcement is needed.

Get Proactive and Stop Fraud Sooner

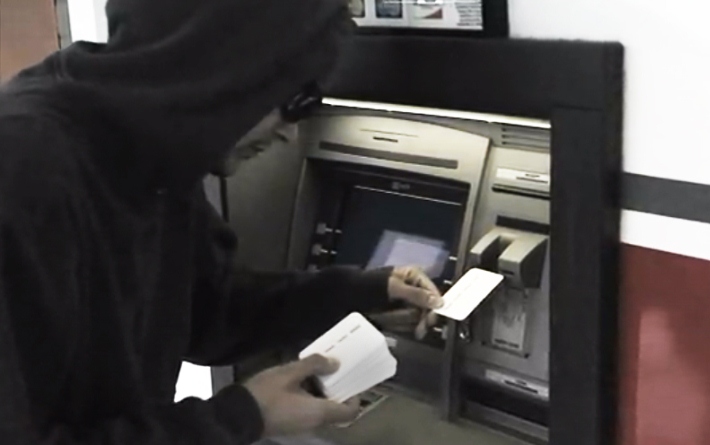

Intelligent video surveillance applications also provide fraud investigators with powerful tools to address the billion dollars in annual losses financial institutions are incurring as a result of ATM skimming and cash harvesting crimes.

Someone loitering at an ATM without conducting a transaction, for example, could be a legitimate customer looking for their bank card or taking a phone call. Conversely, they could be installing a skimming device on the ATM. Once the financial institution’s transaction data is uploaded, intelligent video applications can automatically link the transaction to its associated video and scrubbed the data to provide a report flagging all such potentially suspicious incidents.

Fraud investigators can then quickly determine if the ATM has been tampered with, disable it if necessary and generate a list of the bank cards that were compromised. The fraud team can then cancel the cards in question before they can be copied and used to harvest cash.

Video analytics embedded in a surveillance system can also flag ATM encounters during which multiple cash withdrawals are made by one individual. Once again, the system produces a report of these suspicious activities, allowing fraud investigators to cancel the cards, contact customers and provide police with video clips of the suspect.

Build Customer Loyalty

In the new video surveillance paradigm, financial institutions aren’t forced to wait for concerned customers to contact them about unauthorized withdrawals appearing on their bank statements weeks after their cards have been copied. With intelligent video, fraud investigators have the tools needed to identify when a customer’s card has been compromised before cash can be harvested, allowing the bank or credit union to proactively inform customers and make arrangements for a new card to be available at their branch. This initiative helps build customer trust and brand loyalty, and is an invaluable asset in the competitive marketplace.

Improve Customer Services

Banks and credit unions are also starting to explore the capabilities of practical video analytics developed for specific, real-world applications. Loitering detection analytics, for example, can alert security staff to someone lingering in an ATM vestibule.

Reviewing the video in real-time allows staff to make a quick assessment, confirming if the person is actually using the ATM or if further action is required to ensure customer security.

Intelligent video analytics can also provide valuable information on customer behaviors, which can be shared across the organizations to improve service, marketing and other efforts. Queue monitoring analytics can alert a branch manager to long wait times at teller stations, for example, while other analytics can help a bank assess the success of a marketing display, or how interest in a similar display varies from branch to branch.

And none of this is pie in the sky. Intelligent video is available today and gaining traction around the world.