The network-based physical

security industry has

matured rapidly over the

past few years. As the

technology and other

components of security solutions have

advanced, so too have the customer’s expectations.

Security solution companies

must evolve in order to meet these new

expectations. This requires an understanding

of the technology, the customers’

motivators, issues and hot buttons.

Arriving at that understanding requires

taking a step back to look at

entire solutions. As video management

software (VMS) has become more sophisticated,

so have the accompanying

hardware components.

Proof of this is everywhere. Camera

technology can now provide much

higher levels of detail due to greater

capabilities with megapixel and HD.

Another example is today’s IP access

control software, which offers customers

a more flexible way to manage their

facilities. Innovative monitoring tools

can recognize security equipment that

needs repairs before malfunctions become

expensive or fail completely.

A New Approach

In 2012, Milestone recognized that

these changes were significant enough

to warrant a new go-to-market  approach.

Rather than making changes

gradually, the company incorporated

the new market realities into the creation

of three new business units. Each

business unit would specialize in developing

new hardware, software and related

services to meet the accelerating

pace of changing customer security solution

requirements.

approach.

Rather than making changes

gradually, the company incorporated

the new market realities into the creation

of three new business units. Each

business unit would specialize in developing

new hardware, software and related

services to meet the accelerating

pace of changing customer security solution

requirements.

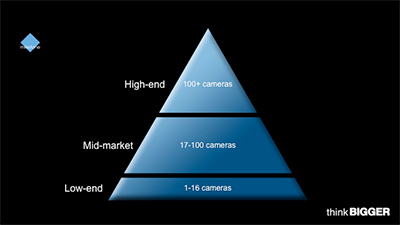

In order to effectively address all customer

segments, Milestone left behind

the old physical security market’s segmentation

model, which was based on

the number of cameras installed per

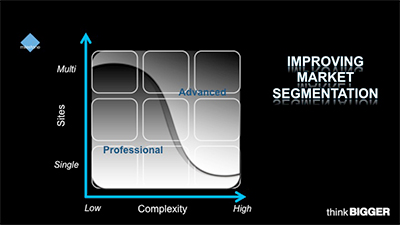

site. Instead, as the graphics below illustrate,

the company began to determine

customer needs based on whether

deployments are needed at one or many

sites and whether security/surveillance

needs are low or high complexity.

National retail chains and utility

companies provide an excellent example

of this new perspective on assessing customer

needs. Each small retail shop may

only need one or two cameras for monitoring,

but there may be hundreds if not

thousands of locations across geographies.

An electrical utility installation,

on the other hand, may be housed on a

single site but have security needs that

are highly complex and critical.

How can a single solution accommodate

customers with such different

needs? Simply put, it cannot. Such

varying needs require a diverse portfolio

of solutions to provide the features

and capabilities appropriate for each

type of organization.

Early Adopters and

Pragmatists

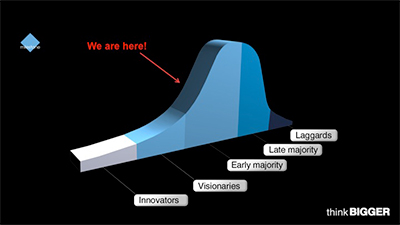

One of the factors driving change in the

network-based physical security industry

is a change in the buyer’s tolerance

and acceptance of technological risks.

There is a very specific type of person

who is willing take the necessary risks

often associated with using new technology.

Known as the ‘early adopter’ in

Geoffrey A. Moore’s landmark book,

Crossing the Chasm, the individuals

who purchased early network-based security

products were risk takers, agents

of change and visionaries. The early

adopters tended to place comparatively

small orders and, perhaps most importantly,

sought out specialized integrators

for advice and assistance.

After a decade-long, continuous improvement

of technology, the adoption

risks have been reduced. Evidenced by

the firmly entrenched acceptance and

usage of networked-based physical security

solutions, this transformation

has enabled the more risk-averse pragmatist

customer, or, in the parlance of

Moore, the “early majority customer,”

to start the security technology adoption

lifecycle.

After a decade-long, continuous improvement

of technology, the adoption

risks have been reduced. Evidenced by

the firmly entrenched acceptance and

usage of networked-based physical security

solutions, this transformation

has enabled the more risk-averse pragmatist

customer, or, in the parlance of

Moore, the “early majority customer,”

to start the security technology adoption

lifecycle.

It’s important to understand that

early majority customers comprise 33

percent of the overall market. As of

2014, this group has only just begun

adopting networked security. This customer

segment is considered “the next

big wave.”

There are several assumptions that

can be made when determining how to

best approach a buyer who fits into this

segment, including:

- The early majority customer, fully

aware of the evolution of the industry,

expects the technology to be

more advanced to address more complex

needs.

- The early majority customer is not

looking to invest in stand-alone

components but in an overall platform

solution.

- The early majority customer prioritizes

the technology’s functionality

and operational effectiveness.

Most significantly, this new early

majority customer is not interested in

investments that are anything less than

rock solid. There are several ways to

make sure the customer has confidence

in the portfolio he’s investing in. The

simplest way is to ensure that each and

every component has customer and

technical “reference-ability.”

Recalibration and

Best Practices

The emergence of the early majority

customer—a pragmatist—and the maturation of the network-based physical security

industry are fundamental changes.

The combination of these market changes

requires not only a new approach to

solutions but also for a much more pragmatic

way of servicing customers.

In a word, the transformations in

our industry call for a recalibration.

While the process of recalibration is

different for each organization, there are

a few tried-and-true general guidelines.

Applying these best practices is critical

to correctly identifying how to most effectively

reach today’s customers.

First, introduce risk-mitigation tactics.

These can include guarantees of

operational readiness evidenced by real

system proof-of-concept, pilots and

rollouts.

Offer a portfolio of hardware, software

and services to address every

need within the new segmented market

model, as shown in the matrix illustration

above, which speaks directly to the

needs of the early majority customer.

These customers expect manufacturers

to address high or low complexity needs

and scale within a project, rather than

just size and scope.