A decade ago, Recurring Monthly Revenue (RMR) tracking

looked like this:

| Dealer accounts: |

1,000 |

| Avg. rate/account: |

x $25 |

| Dealer RMR: |

$25,000 |

Sadly, this wonderfully simple approach rarely works these days,

due to the rapid adoption of interactive services (Alarm.com, Total

Connect, etc.) and the increasing stratification of subscriber service

levels. Yes, most dealers still do have a base of plain vanilla digital,

or cell-based, accounts at standard base rates. With the wide range

of new services now available, bundled or a la carte, the metrics of

tracking and reporting RMR are evolving quickly. Dealers need to

embrace both consistent account management processes and software

powerful enough to give them the key information they need.

“When dealers talk to me about their RMR, the first thing I ask is

for them to break it down for me. That’s often when things bog down.

Good RMR reporting is one of the biggest challenges we face,” said Jim

Wooster Jr., president of Alarm Financial Services, Corte Madera, CA.

Because RMR is the basis for dealer valuations both in purchase

and financing transactions, an upgrade of our approach to RMR may

be in order. It has become far more complicated, so we need to rethink

our process for defining RMR, tracking RMR growth, tracking

attrition, accounting for rate increases/decreases, etc. As Cornerstone

has worked with dealers, and especially with the funding companies

that finance them, we’ve evolved our software and reporting to try to

keep up with this brave new world. This white paper shares some of

our conclusions.

DEFINING RMR

The first step is defining RMR—below is a list of typical recurring codes:

| Code |

Description on Invoice |

| MAI |

Maintenance Agreement |

| MED CSS |

Medical Monitoring Services |

| MON |

Monitoring Service |

| MUSC CEL |

Cellular Monitoring |

| OCR |

Open & Close |

| OCRSUP++V |

Supervised Open Close |

| PMT PLAN |

Payment Plan |

| POTSLINE |

Monthly Monitoring Phone Line |

| TC2 |

Total Connect Stand Alone |

| TC2 S TC2 |

Adv with Automation |

While all of these are recurring charges, buyers and funding companies

will not likely include them all in valuations. By definition,

payment plan charges will roll off at the end of the agreed-upon payment

term, so would usually be excluded. Dealers using payment

plans would want to exclude these amounts when calculating attrition,

to avoid overstating that percentage. Some funding companies

would exclude maintenance agreements from their funding formula.

The bottom line for defining RMR is that, as with many things

in life, it depends. So from a software perspective, it’s important to

provide a code-by-code opt-in such as this:

Flagging ‘Monitoring’ as ‘Core Recurring’ while excluding ‘Payment

Plan’ allows precise tracking and reporting, and the flags can be

quickly adjusted based on who’s getting the reports.

In most cases, buyers/lenders will also disqualify seriously pastdue

accounts. For that reason, it is easiest if at least one software report

provides an RMR tally with a ‘Collateral Calculation—RMR for

accounts with aging less than 90 days’ filter built in.

| Collateral Calculation — RMR for accounts with aging less than 90 days = $23, 355.74 |

COUNTS OR DOLLARS?

Once RMR is clearly identified, the next issue is whether to track

dollars, counts or both. The old model was “average RMR” times the

number of accounts, to arrive at a valuation or a funding base. In our

view, the best RMR metric is Total RMR Dollars, after adjusting for

non-core/non-qualified recurring charges.

Below is the first line of our software’s RMR Tracking Report:

| Recurring Changes Summary |

Amount |

Charge Count |

Account Count |

| Beginning RMR

(includes Section 5 Continuing RMR) |

76,418.38 |

1,819 |

1,012 |

A buyer/lender cares most about the green number above, but we

also provide both the number of accounts (site locations) and the

number of charges. Those numbers definitely tell a story. If the number

of recurring charges are about the same as the number of accounts,

that suggests that either the dealer likely has a more traditional

base of accounts—few add-on services—or that the dealer

bundles charges into a single amount. In the above example, the average

account has roughly 1.8 charges and pays an average rate of over

$75. Those metrics would normally be quite attractive to buyers/

lenders, because of the high rate and the relatively high ratio of charges

to accounts.

So dollars are most important, but counts are also very useful to

help establish averages, as noted in the paragraph above. Good account

management software should provide both quick summaries

and trends over time, as well as underlying counts and the ability to

export raw data details to spreadsheets in order to allow for slicing

and dicing data as desired.

TRACKING RMR GROWTH

Growth in RMR is more complicated these days, and can be the

result of:

- New accounts (brand new, or re-signed)

- New services added for existing accounts

- Rate increases to existing accountsIn addition, it’s worth reviewing a couple of other items:

- Future RMR not yet invoiced

- Pending RMR not yet online

RMR for new accounts is straightforward, though some new accounts

are actually re-signed accounts due to a move. Dealers with an

aggressive move/re-sign program can sometimes demonstrate that a

chunk of their attrition is actually not lost accounts, but re-signed

accounts. Flagging these accounts in the software should allow for

a separate line item for re-signs. Likewise, it’s valuable to break out

both the dollars and the counts for new services added by existing

accounts, as well as for rate increases.

If a dealer puts an account online, but has not yet billed the recurring,

is that RMR? Similarly, if a prospect accepts a proposal from the

dealer, but the install has not yet occurred, is that RMR?

It is potential RMR, but it’s not active RMR, so our reports exclude

these categories from current RMR. Nevertheless, it’s valuable to report

these numbers “below the line” as FYI items.

This at least provides the dealer a view of RMR in the pipeline and

can provide meaningful information especially for owners and managers—

a preview of the backlog, accounts that will be added soon.

TRACKING RMR ATTRITION

RMR attrition is more complicated as well, and can be the result of:

- Cancelled accounts

- Cancelled services for existing/continuing accounts

- Rate decreases for existing accounts

These three are just the flip side of the growth discussion above.

However, managing attrition can (and often does) mean the difference

between success or failure. You can’t manage what you don’t

measure, so entering reasons for every cancellation into the account

management software is critical:

| Cancel Reason List |

| Business Closed |

| Can’t Afford |

| Don’t Use Syst |

| False Alarms |

| Moved |

| Non-payment |

| Service Problem |

| Went to Compet |

Assigning a cancellation reason should allow for easy—and extremely

valuable—reporting:

Some of the cancellation reasons are controllable, some are not.

The most common reason for cancellation involves a move of some

type. In the above chart, ‘Moved’ and ‘New Location’ for a business

adds up to over 36 percent. Properly managing move-in/move-out

scenarios can have a huge impact on ‘net growth’. A high percentage

of re-signs due to customer moves is the hallmark of a company that

both tracks its move-driven cancels, and has a pro-active program to

manage these subscribers. Yes, it’s complicated, but it’s also lucrative;

good move programs can often generate brand new customers, from

the move-in side of the equation.

PUTTING IT ALL TOGETHER

Now that we’ve determined definitions, growth elements, and attrition

elements, it’s time to look at the big picture. RMR changes can be

reviewed for one year, two years, or perhaps six months to see more

recent trends.

| |

Average |

Annualized |

| RMR New Growth Rate / Rate Increases % |

2.1 |

25.7 |

| RMR Attraction Rate / Rate Decreases % |

-1.2 |

-14.9 |

| RMR Net Growth % |

0.9 |

10.8 |

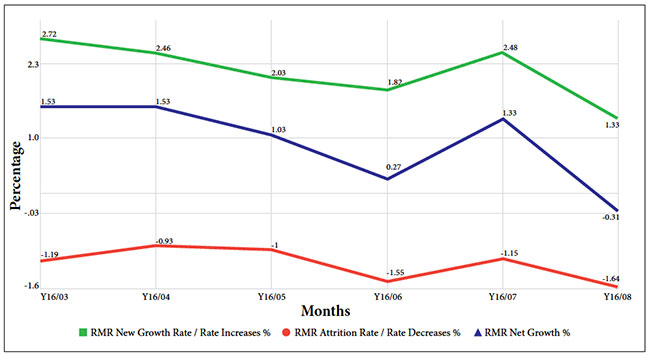

This summary shows growth rates in green, attrition (negative

growth) in red, and RMR net growth in blue. In this example, top line

RMR growth is excellent at 25 percent plus annualized, but attrition

is also quite high at about 15 percent, resulting in net growth of more

than 10 percent.

Just as valuable is a visual of trends for these three numbers, over

time like the line chart on the next page.

Line charts like these give managers a quick read on where things

are going. In the example, the blue line (net growth) seems trending

downward—mainly because growth (green line) has slowed. So it may

be time to review the growth program(s), and take corrective action.

From there, good software should allow for drilling down into

each month to see the metrics—growth elements and attrition elements,

by dollars, charge counts, and customer counts:

Y16/08

|

|

|

|

| Recurring Changes Summary |

Amount |

Charge Count |

Account Count |

| Beginning RMR (includes

Section 5 Continuing RMR) |

79,558.04 |

2,185 |

1,915 |

| Section 1: New RMR /

New Accounts |

843.88 |

18 |

17 |

| Section 1: New RMR /

New Accounts (Re-Signed) |

39.99 |

1 |

1 |

| Section 1: New RMR /

Existing Accounts |

151.49 |

5 |

5 |

|

Section 2: Stopped RMR /

Closed Accounts |

-1,230.70 |

35 |

35 |

| Section 2: Stopped RMR /

Open Accounts |

-67.99 |

2 |

2 |

| Section 4: Incremental RMR

Increases |

26.01 |

3 |

3 |

| Section 4: Incremental RMR

Decreases |

-3.00 |

1 |

1 |

| Ending RMR |

79,317.72 |

2,172 |

1,897 |

The above snapshot is for August 2016. The summary numbers

smooth out the ups and downs by taking averages of multiple months,

but a company should be able to scrutinize details for a period where

performance was relatively strong or weak. A good software reporting

system should allow dealers to go further, providing individual

account and charge details behind these summary numbers. That

level of detailed analysis will allow owners, managers and staff to review

the ‘nitty gritty’ stories behind the raw data and then try to optimize

things that worked, correct things that didn’t, or both.

ADVANCED METRICS

In the coming years, security dealers, along with industry buyers and

lenders, will likely start grouping its accounts based on service levels,

such as:

Each of these groups will have its own metrics—average rate,

charges (services) per account, and so on. For example, perhaps the

Basic subscribers pay an average of $22 per month. Some analysis

shows that many of these subscribers pay relatively low rates of $15 to

$18 per month, perhaps because they were signed on many years ago.

Implementing a selective rate increase for these low rate accounts,

which is fair given current market rates, can bump up the $22 average

to perhaps $23 to $24 and immediately improve margins. Given easy

access to the detailed growth and attrition data described earlier, it’s

much easier to take targeted action to improve the bottom line.

From a marketing standpoint, grouping accounts also allows dealers

to focus on upgrading Basic accounts to Standard, and Standard

accounts to Premium. Programs like this are especially important

now, as cable and media companies aggressively advertise to try to

poach accounts from traditional dealers. Assigning each account to a

group allows a dealer’s management team to set goals for upgrades as

well as for new accounts. It’s much less expensive to cross-sell existing

customers than it is to find and sign on new customers.

Finally, while RMR is the most convenient metric for buyers and

lenders, even more important is the margin each RMR segment generates.

“Once we get a breakdown of the RMR, we need to have the

dealer show us how much they make on each segment,” says AFS’s

Wooster. “The top line RMR is a great starting point, but what matters

most to us is profit by type of recurring.” Again, good software

should allow for assignment of costs—such as wholesale monitoring

fees, billing costs, and other variable costs—to each recurring charge.

ACCURACY BREEDS CONFIDENCE

Whether it involves funding, buying and selling accounts, or simply

ramping up growth, one of this industry’s biggest issues is determining

accurate growth and attrition rates. Many, many deals have blown

up because of this. With the dynamism in this industry right now, it’s

more important than ever to invest in account management systems

that allow dealers to easily track—and build—their RMR.

If growth financing is needed, being able to immediately generate

the reports and metrics a lender needs will breed the confidence that

lender needs to extend credit. If a dealer is thinking of selling accounts,

the same holds true – solid RMR reporting gives buyers confidence

that the dealer ‘has its act together’, and may therefore boost

the multiple a buyer is willing to offer. “Buyers and lenders don’t like

uncertainty,” Wooster from AFS concludes. “Uncertainty reduces valuation

multiples, and on the flip side, accurate reporting can improve

the valuation a buyer or lender assigns to a dealer’s accounts.”

The vast majority of dealers are neither selling nor seeking a

loan, but they are certainly looking to both retain their customers

and drive faster growth. Investing the time and money to implement

an industry-specific software platform will provide a very quick payback,

by offering a real-time look at how the business is performing,

and why. Only then can confident decisions be made to set goals, and

to follow through with targeted and measurable programs to achieve

those goals.