Commercial and Retail Buildings to be the Fastest Adopters of Remote Monitoring Services

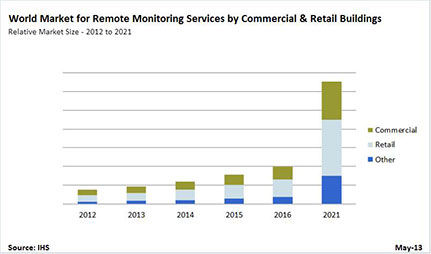

Commercial and retail end users will drive the growth of remote monitoring services in intelligent buildings, accounting for more than 80 percent of the $400 million market in 2016, according to a new study by IMS Research, now part of IHS Inc.

Remote monitoring in intelligent buildings is a service offered by third-party companies that audit and report on the operational performance of a building. The services have two key selling points. First, auditors can make recommendations to save energy costs by determining, for instance, a more efficient schedule for the building automation system. Second, the building owner can reduce internal staffing costs for the facility by using a third-party service provider.

The figure below presents the forecast growth for remote monitoring services used in commercial and retail buildings from 2012 to 2016, with a snapshot of what the market will look like by 2021.

“Remote monitoring services are gaining increased traction as building owners find significant savings to be made in terms of both decreasing energy bills and reducing staffing costs,” said Sam Grinter, market analyst for building technologies at IHS. “The drive to reduce overheads has been reinforced over the last five years by tough economic conditions.”

“Commercial and retail end users have been the fastest to take advantage of remote monitoring services in intelligent buildings, because the slashing of operational expenses has been a higher priority for them than for government or institutional end users,” Grinter noted.

Remote monitoring service providers have found success with commercial and retail end users by demonstrating the effectiveness of the systems in trial deployments. Then, once the return on investment is demonstrated, services are rolled out throughout the wider building portfolio. The services in intelligent buildings are looked upon as a competitive advantage, which explains why adoption has spread relatively quickly.

As the market develops further, other end-user industries such as education, government, data centers and hospitality will increasingly take advantage of the services, IHS believes. The systems are expected to not only improve building efficiency, but also reduce internal staffing costs for monitoring and maintaining buildings.