The Road Ahead

Ten stakeholders are expecting a rosier landscape in the 2011 security industry marketplace

As we reach the end of 2010, and hopefully find a surer footing for the years ahead economically, the staff of Security Products magazine sat down with several key players in the security industry to gauge their thoughts on technology resources and the economic impact for the coming year. Our three questions have been asked of:

- Steve Fisher, CEO of Open Options

- Fredrik Nilsson, general manager of the Americas for Axis Communications

- Mas Kosaka, president and CEO of PCSC

- Eric Fullerton, chief sales and marketing officer for Milestone Systems

- Jill Johnston, president of KJB Security Products

- Jumbi Edulbehrum, vice president of business development at Next Level Security Systems

- Steve Kuntz, president of KBC Networks

- Bill Taylor, president of Panasonic Systems Network Co. of America

- Bill Klink, vice president of security and surveillance at FLIR Commercial Systems Inc.

- Rob Shaw, COO, Video Insight

Q. With the overall economy trying to rebound, what is your forecast for the security industry in terms of technology and economic impact in 2011?

Fisher: The growth and overall demand for our products in 2010 was primarily due to growth in non-traditional markets, such as school districts and municipalities. In other words, governmentsponsored activities increased as the commercial side of our business was flat. In 2011, we anticipate a shift back toward a more traditional mix of business between government and corporate as a number of aging Y2K-vintage investments are in dire need of replacement or upgrade. We anticipate rather dramatic growth in 2011 as corporations react to an improving economy and act on the suppressed demand that has been building through the recession years.

Nilsson: That is a great question, and one that we’ve been hearing now for some time. As the economy in general continues to rebound in North America, albeit not with great strength, the security market also has rebounded. But what’s most interesting about the transition out of this recession is how it seems to have accelerated the shift from analog CCTV to IP surveillance. IP surveillance has been growing all along and that growth has actually accelerated over the last three quarters, while analog has remained flat and even started to decline.

This might come as a surprise to some people who assume that a tough economy would cause end users to back older, more established technologies because of the perceived lower cost. But in fact, this acceleration trend of new technology during a recession has happened before in other relevant markets, like the analog film and digital camera market.

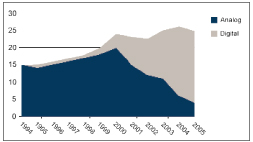

Look at the graph below that depicts sales of analog film (blue) versus digital cameras (gray), in millions of cameras sold per year in the United States.

After the tech bubble burst in 2000, consumers began putting their spending power behind digital, the newer technology. At the same time, manufacturers began concentrating research and development power on digital so that they would be able to offer more innovative products when consumer buying confidence rose again. When making a buying decision -- especially in tough times -- both consumers and businesses tend to invest in products that will prepare them for the future instead of spending a limited budget on a technology that could soon be obsolete.

Kosaka: The rebound is slower than expected but it definitely has begun. The implications to our industry may even be slower, since spending priorities for security have been historically low.

Fullerton: The financial crisis of 2008-09 accelerated the adoption of networked video, and we see an evolutional technology development where the known elements are already in motion. Some specific mentions are network cameras at the low end will cost less and be easier to use, mobility also will drive faster convergence to IP, analytics solutions will have minimal impact on purchasing decisions in 2011, with low-end analytics being adopted at the edge -- on cameras -- and higher end analytics residing on servers.

Demands will continue for ease of use and increased functionality in VMS. The VMS market will begin to consolidate, hosting may begin to open up the private and SOHO segments in 2011 but will have little impact on enterprise surveillance, and skilled A&E and channel partners will continue to be the main drivers for decisions by end users.

Johnston: Despite the recent economic struggles, we have continued to invest in technology and new product development in anticipation of economic recovery. We are excited to see that all indications point toward strong growth in 2011, fueled by a combination of technological advancements and an overall focus on security, in both the private and public sectors.

Edulbehrum: There are a number of things to consider in terms of technology and economic impact in 2011. First, end users are starting to spend but they are spending smart. They want to find technologies and solutions that enable them to leverage existing infrastructure, but in an intelligent way. They will look to migrate from traditional analog systems to digital over time and seek out technologies that enable them to migrate at their own speed. End users also are looking for ways to lower integration costs. Unified networked platforms that combine multiple subsystems, such as video management, analytics and access control, into one platform reduce these costs because these systems are integrated from the point of manufacture. This substantially reduces costly and time-consuming software development and custom integration.

End customers also are looking for solutions that will reduce operational costs, such as power consumption and cooling. Solutions that combine multiple subsystems into one complete system replace large, high-energy consumption servers and racks, but at the same time take up very little physical space and consume extremely low levels of power.

Of course, the use of intelligence, such as video analytics, will continue to grow. End users can leverage video analytics to make more sense of their video data. Video analytics such as people counting can inform a business how many customers entered over a given time to determine conversion rates or staffing plans. Services, such as banks, can calculate wait times to evaluate customer satisfaction levels.

In 2011, it’ll really be about doing more with less -- less integration, less power, less stretched resources -- while increasing capabilities. Manufacturers have to adapt to end users adopting this approach, and there are a number of vendors who are embracing this with new solutions developed to specifically meet these needs.

From an integrator standpoint, the systems integration will turn around in 2011. Integrators will begin to see projects come to life that were previously delayed due to the economic situation. The positive aspect of the economic downturn was that leading integrators used this time to update the skills of their staff. These resellers will prosper, while others will have a hard time.

Kuntz: When it comes to technology in the security industry overall, the key trend is clearly the ongoing shift toward IP products. From a transport infrastructure standpoint, we expect to see the same evolution. That is, a gradual shift to IP at least until the economy shows significant signs of improvement.

In terms of the economy, we expect to see continued growth overall, as the decline in analog product sales will be largely outpaced by IP growth.

Taylor: We will, thankfully, continue to see economic recovery in the security industry in 2011 as users upgrade systems and new construction starts to pick up. Technology advancements have been ongoing even during the economic downturn, and customers looking to install systems today can benefit from a range of enhanced and expanded product choices offering new capabilities to the market.

New choices include Panasonic’s line of i-PRO SmartHD network cameras, which provide high-definition image quality and exquisite color reproduction using lower bandwidth. i-PRO SmartHD can dramatically improve performance and functionality of surveillance systems by offering capabilities such as face recognition and face matching. The ability to provide higher resolution allows a reduction in the number of cameras needed, and enhanced camera capabilities enable systems to do more. It all contributes to lower total cost of ownership.

Technology will help to drive industry growth as the market embraces new capabilities for various applications. Technology also makes it easy to integrate existing analog cameras into IPnetworked systems. Any user who has a well-functioning analog system can expand and build on the system rather than strip it all out and start from scratch. The bottom-line cost of the final system will reflect the wisdom of preserving the value of existing resources.

This scenario plays especially well considering lingering economic concerns and the corporate needs for cost justification and to show a return on investment.

Klink: The security industry overall will likely grow at a more rapid pace than general economic recovery. Several factors will contribute to that growth, including the increased adoption of new security technologies, increased deployment of perimeter security systems resulting from federal mandates and spending by municipal agencies using federal grant and Recovery Act money.

Shaw: In the video surveillance arena, we see excellent growth prospects for 2011. The key technology drivers in our field are the huge improvement in image quality due to the prevalence of megapixel cameras. The megapixel and multimegapixel cameras will continue to push the industry away from analog systems toward pure IPbased systems. In turn, megapixel cameras require increased expenditures on IT infrastructure including storage, processor capabilities and bandwidth.

Q. Technology drives the security industry. What products on the horizon will change the way security is handled?

Fisher: Software, software, software. Certainly, there are some fine hardware technologies emerging with lower-cost IP cameras and a plethora of new and improved biometric devices, but the engines of deployment for these devices are software.

We anticipate a sustained focus on interoperational capabilities of control software between various products to deliver a managed integration of divergent systems. Likewise, IP-connected security devices will continue to displace traditional wired products.

Nilsson: I actually believe that we’re in the midst of a technology trend today that is not only changing the way security directors use video but will be around for quite some time. That’s HDTV. As you say, technology drives the security industry. But I would take that a step further and say that consumer technology drives the security industry. Imagine a security manager sitting at home watching a movie or football game on a flat screen HDTV just hours after monitoring grainy security footage from an analog feed. It didn’t take long to ask, “Why can’t I have this same picture at my job where video quality is crucial?”

Even though network video offers much better image quality by definition, we saw that this HDTV experience would continue to change end-user expectations not only for higher pixels, but also for full frame rate, color fidelity and the 16:9 aspect ratio. Since Axis launched the first HDTV network surveillance camera in 2009, we’ve seen growing interest for high-definition video not only in major installations, but also by smaller, SMB-type customers.

But while new imaging technology has opened the door for consumer- quality video in security, it’s important that manufacturers and integrators properly educate users on the differences between standard, HDTV and megapixel resolutions. Also, and more importantly, customers must understand when each is appropriate for their specific application.

Kosaka: Our security industry tends to wait out new technologies, but in saying so, technologies that enhance the quality and reliability of products will always be accepted. New products will enhance communications and lower installation methods. Products incorporating PoE, dual communications and wireless communications technologies will be prominent.

Johnston: There’s no doubt that technological advances are directly linked to the security industry. One of the areas that has reflected significant advancements is in the quality of video surveillance available to everyone from businesses to regular consumers. Just a few years ago, surveillance cameras -- especially the ones built into covert monitoring devices, were much lower quality than what you can find today.

With advances in technology, we just introduced a true highdefinition wearable DVR camera kit, smaller than a pack of cards. These high-definition cameras will soon be built into all types of surveillance equipment, cost-effective enough even for personal use. By making this type of high-quality video security surveillance available to both professional and DIY users, it will greatly increase its effectiveness and will likely lead to greater use.

Edulbehrum: Products that integrate various security functions to provide users with a seamless experience across systems will lead the way. The integration of traditionally separate subsystems into one platform provides end users with the opportunity to take full advantage of their security technologies and network capabilities. Companies with multiple sites and facilities require flexibility and subsystems into a single platform make day-to-day tasks more efficient and highly secure. Furthermore, integrated networked security systems not only enhance safety, they can ensure best practices are followed to increase business efficiency.

The innovation we’ve experienced in the consumer market has had a direct impact on technologies now being released for security. These new products take price and performance to a new level. Instead of piecing together separate components from various vendors, a single networked platform integrates various management functions available all at once and is operated over a single user interface. In addition, these platforms require no licensing fees, making complex equations a thing of the past.

Remote management services are another growing trend. These services allow users not only to access data from a security device but to interact with these devices off-site and provide users with a view of recent activity at all sites. Furthermore, a remote management system will automatically generate reports from specific events, which helps determine if security best practices or business policies need to be modified. This service will also automatically update software, eliminating the need for on-site support or user intervention.

As you can see, tomorrow’s technology enables end customers to streamline not only security efforts but business operations.

Kuntz: In general, all things IP will continue to drive the security industry forward. Specifically, megapixel camera technology, computing and storage in the cloud, and hosted video systems will play a key role. As ROI analysis and other nonsecurity specific benefits are realized with these technologies, they will change the way security technology is viewed and handled.

Taylor: New products with on-board intelligence are making it easier and more cost-efficient to implement tighter security controls and higher levels of integration. An example is the UniPhier computer chip used inside each of Panasonic’s new i-PRO SmartHD network video surveillance cameras to provide unsurpassed image processing and better interoperability among system components. The latest generation of Panasonic’s UniPhier largescale integrated circuit is made possible by a high-density microstructure processing technology that incorporates 250 million transistors on a single, low-power-consumption chip to provide superior performance, image quality and efficient H.264 compression. Uni- Phier is a key component that differentiates i-PRO SmartHD network video cameras and makes possible sought-after features such as face detection with NVR embedded real-time face matching capability, which was a challenge for previous-generation technologies but is now robust and available.

New developments in IP/networked systems also allow seamless integration of previously disparate systems such as point of sale and classroom audio with surveillance. In schools, Panasonic’s classroom audio systems now include one-button access to immediate assistance within reach of the instructor. A wireless microphone worn around the neck can send a silent alarm to trigger video surveillance if there is an incident in the classroom. These are all examples of ways Panasonic’s various products can contribute to the security function, even as they serve general functions in the organization. IP/networked systems are driving installations across a wide array of industries.

Klink: There are many excellent new security products, but one very exciting technology trend is the continued commercialization of erstwhile military technology. For example, RADAR, thermal imaging and color night vision technologies are now commonplace in industrial security environments for threat detection and alarm verification. Until recently, those technologies were either not suitable as commercial security devices, or they were simply too expensive for industry and municipal agencies. Now, however, lower price points on thermal cameras make night vision technology a common solution for the general industrial and even residential security markets.

Shaw: We are seeing more multi-megapixel cameras coming on the market with lower prices. With improved image comes increased need for efficient ways to transmit and store these larger images. Video management systems that can manage these large images efficiently will be in high demand.

Q. What are the top end-user purchasing preferences going into 2011?

Fisher: We recognize significant pent-up demand for more technologically adept security systems. Over the last few years, we have worked with a number of major corporations that have had the need to replace and upgrade technologies but have been stopped due to recessionary pressures. Many of those systems are on their last legs of functionality, so we feel basic technology updating will prove to be a significant engine for growth in 2011. Clearly, updated software, as well as IP-connected devices will be near the top of many customers’ lists for 2011. managers, directors and their staff are becoming better educated each day, and they’ve learned how to closely differentiate between product offerings instead of merely writing a spec for the same old “16 channels at 7.5 fps.” Integrators must have information on a wide array of network video products that offer different features -- from high-resolution, to intelligence, to audio-support, to PTZ control, to ease-of-install design -- all at varying price points. Fortunately, we continue to educate our integrator partners so that they can answer and appease the technology and general surveillance questions they get in the field.

Additionally, and as always, end-users want to preserve cash. This opens the door for systems based on monthly fees that fall under operating expenditures instead of the upfront investment that falls under capital expenditures. This service-provider model is becoming increasingly attractive.

And to reiterate once more, large, established end users who have years of experience in a cyclical economy know that they need to invest in the future to be competitive. Therefore, they consider the latest technologies to gain an advantage over their competitors once the economy rebounds.

Kosaka: Many of the large end users already have systems in place. I believe their goals will be to upgrade their existing systems with state-of-the-art products. End users will scrutinize new products and ensure that future technology enhancements can be easily incorporated into their system and be cost effective.

Fullerton: What we are seeing in project requests and specifications in our global pipeline for video management platform deliveries is that the following is provided and documented: ease of use, performance, scalability, integration capabilities and service.

Johnston: We are noticing two distinct trends that will extend into 2011 and onward. The first is directly related to the smartphone revolution that has been the mobile phone market over the last couple years. With an increase in use of smartphones capable of doing almost everything that a computer can do, people are looking for ways to monitor those phones. Whether it be for parents, spouses or employers, we are seeing a noticeable increase in both requests for and sales of cell phone monitoring products.

The second purchasing preference that we expect to continue is the preference for well-built, professional-quality security and surveillance equipment. We manufacture and distribute products that we know are high quality, which ensures they will last. With many low-quality knockoffs flooding the market, consumers who purchase these imitation products quickly realize that they got what they paid for. There’s no substitute for the real thing, which is why we strive to distribute only products that we can ensure have high quality and dependability.

Edulbehrum: End users will search out products and services that enable security staff to work smarter and enable business to be more effective with fewer resources. They also will look for solutions that have the lowest total cost of ownership and can leverage the network infrastructure. At the same time, providers that are able to provide end-to-end services cost-effectively to customers will be the ones that have the most success in the market. Overall, I think the market is primed for growth in 2011, from both technology innovation and increased demand.

Kuntz: End users are looking for value and ways to extend the use of their legacy systems. In the short term, this will drive the need for hybrid technologies such as video encoders, DVRs and NVRs.

End users considering new systems will largely look at IP solutions.

Taylor: IP/networked products continue to be the hot trend, and implementation of networked systems is occurring across existing and new platforms.

Analog solutions also are continuing to sell, particularly the higher performance cameras. Devices, such as smart encoders, are allowing easy integration of analog and IP system components.

Today’s market offers integrators and users an unprecedented wealth of technology choices to meet any application need with unsurpassed functionality and bottom-line benefits.

Klink: End users continually seek products that support open industry standards that make them easy to install and interoperate with other complementary technologies. One example of this trend is the Open Network Video Interface Forum (ONVIF).

Users also are increasingly drawn to new technology that solves previously intractable problems, such as thermal cameras and color night vision technologies to obtain high resolution video in very dim or no light environments.

Shaw: Once the end user sees the image quality of megapixel cameras, he is hooked. You can’t put the megapixel genie back in the bottle. That will drive more end users toward purely IP-based video systems and the infrastructure to support them.

This article originally appeared in the issue of .