Online Exclusive: Top Five Myths About IP Video Solutions in Banking

Mobile banking has evolved over time and, if you ask most consumers, it’s something they’ve come to trust and rely on as usage numbers continue to rise. In this article, Stephen Joseph explores the five most common myths of IP solutions in the banking environment.

- By Stephen Joseph

- Apr 30, 2013

Less than a decade ago, conducting a banking withdrawal or deposit meant walking into a retail branch, approaching the teller window and making a standard transaction. Today, most people bank from the comfort of their own home – or office, or train or passenger seat in a car. Mobile banking has evolved over time and, if you ask most consumers, it’s something they’ve come to trust and rely on as usage numbers continue to rise.

If consumers have evolved and adopted the Internet as a standard medium for handling banking transactions, why has the banking industry been slow to adopt IP technology as a solution standard for physical security?

One reason for the slow adoption is in part based on the proprietary design of existing systems combined with today’s IT departments being challenged to support disparate systems. This means they have multiple systems with multiple functions to understand all while trying to maintain critical network security and integrity across the entire company.

To put it frankly, many IT departments in the banking world, IP video is considered yet another disparate system that they must “worry about”.

There are many advanced technologies that could improve bank security procedures and system cost – such as edge storage with integrated VMS running in-camera, hosted video solutions that utilize banks’ data centers, intelligent applications and advanced imaging technologies. But before these topics can be even remotely considered, there are five popular myths of IP video solutions in the banking world that must first be addressed.

Myth #1 – IP video isn’t secure: Since IP video’s inception, IT security has been one of the banking segment’s main concerns for not wanting cameras and recording devices connected to their enterprise network. This is primarily because most analog system DVRs with network capabilities that they are familiar with come with pre-installed proprietary software with no ability to install Anti-virus software. Without the required IT approval to attach the DVR to the enterprise network, remote functionality is severely impacted. Yet in an environment where the ability to conduct timely investigations is critical, remote connection could make the difference in improved operational efficiencies, retrieving critical video data for law enforcement and closing out investigations in a timely manner.

Because of this, physical security managers in banking have started to realize that IP video solutions can not only help augment diminishing security staffs, but can also improve investigation processes in a secure manner. This has been a catalyst to not only educate themselves but also their IT counterparts.

IP video devices need to be attached to an enterprise network in order to take full advantage of its ability to integrate with other security solutions. Today’s best IP-based security devices should be considered another network appliance to an IT staff with confidence, as they will meet most of the same network security standards and employ multi-level passwords, SSL encryption, VPNs and firewalls. When combined with today’s open technology standards, these devices should be accepted by most IT departments to be easily and securely attached to a corporate enterprise network – without causing any compromises.

Myth #2 – IP video will take up too much bandwidth: Bandwidth consumption is the second major concern in the banking segment. The belief is that video – especially high-quality video – running across the network will severely impact the bottom line by slowing business-related traffic. This translates to dollars lost. Although this is a logical concern for someone new to the technology, proper network design and camera configuration by an experienced integrator will show the exact effect that the proposed system with have on bandwidth – which should quell many concerns.

With that in mind, many physical security managers have started including their respective IT managers as part of their overall security strategy to better understand bandwidth needs and consumption. This allows them to educate their IT counterparts on video compression advancements, get initial buy-in for future solution strategies and lend assistance with scaling network requirements (and potentially share budgets) to include physical security needs.

Ultimately the benefit that has come out of this new collaborative approach is that IT managers are starting to realize that video will periodically need to be accessed over the network. However, with the rise of extremely efficient compression methods like H.264 and edge functionality controls inside network cameras, bandwidth requirements have decreased significantly.

Remember: Bandwidth consumption is contingent on how effectively the overall system is designed, which takes planning. With the use of event-based and scheduled recording or local NAS drives, there’s no need to stream countless amounts of video over the network to a remote storage device.

Myth #3 – IP video isn’t cost effective: Most physical security managers in the banking segment are constantly faced with the challenge of doing more with less. They are very accustomed to sticking with what has been the best solution for their budget: currently analog CCTV. Since an analog camera is essentially a dumb device that can see in a lower resolution, it stands to reason that it would be cheaper than today’s advanced HDTV-quality IP cameras. But if you are only comparing apples to apples, analog camera vs. IP camera, you’re neglecting the total cost of the analog system over time vs. what the IP system will cost during the same time period.

Unlike an analog camera that is totally dependent on the head end for video processing and management, IP cameras change the game by allowing a new way of designing and utilizing video solutions. An analog system may be the least expensive solution for the first year of deployment, but the bank is then boxed in by having to roll out DVRs that normally have 16 or 32 available ports. If a 16-channel DVR has reached capacity but another camera or two must be added to monitor the lobby, you either have to add an additional expansion module or DVR, which can be very costly. With tight physical security budgets, a more cost effective long-term solution would be to design an IP system with future scalability only limited by the VMS selected.

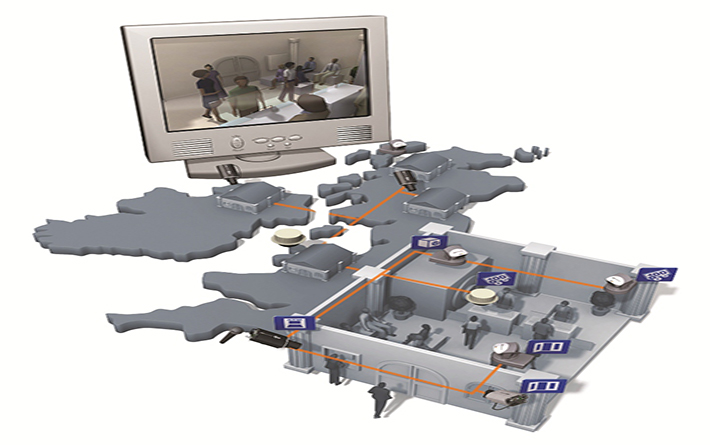

Additionally, today’s IP cameras are intelligent devices that allow for video processing within the device. If comparing to analog, it’s the difference between an old flip phone and a smartphone. Both will make a call, but one is clearly a more advanced device that can process a plethora of downloadable apps that are constantly being developed and rolled out to take advantage of the smartphone’s capabilities. Value per cost is much in favor of an IP solution. One such value – easy remote control, management and investigations, especially for organizations that cover a wide geographical area – leads to less costly travel and faster incident resolution. This too should be factored into total cost considerations.

Also, IP cameras can be leveraged individually, provide distributed video processing capabilities and offer redundant onboard storage in case of a network interruption, which eliminates the single point of failure of a traditional DVR. Routine maintenance and recording failures common with DVRs are eliminated because network video updates can often be done remotely and before a failure – again saving time and money.

Next consider that the number of remote or kiosk ATM locations is constantly growing. Deploying a DVR solely for one or two analog cameras drastically increases the overall cost for providing video coverage. In a total IP solution, a single camera can be installed with in-camera SD card or local NAS storage (i.e. “edge storage”) and remotely connected to provide the same intended coverage.

Combine all these benefits and the total cost of ownership with benefits gained far outweigh the initial investment for the future scalability ahead.

Myth #4 – Going to IP means I have to start from scratch: The goal for physical security managers is to improve the efficiency of their operation and stay within budget. In financial institutions, physical security departments are a critical expense to the very precious bottom line. It’s no wonder that when most security managers are weighing how to leverage new IP video solutions to improve their overall operations, they are somewhat concerned that it means they must make a huge initial investment to get started.

However, with today’s hybrid technology, migrating to a totally IP-based solution is much easier and full of different options. The ability to utilize existing cameras, existing coax cable, video encoders and Ethernet to Coax converters makes it possible to leverage most of an existing system (and investment) while migrating to digital technology as budgets permit.

In the banking segment, the physical security manager can get the best of both, allowing older devices to be replaced over time while providing improved future scalability, image quality and functionality. This ability to envision an acceptable scaled migration plan that can be budgeted for becomes a more realistic strategy, and enables much better use of live and captured video.

Myth #5 – There aren’t very recognizable differences between analog and IP: On the surface, both technologies perform a core task: record and replay video. Ninety-nine percent of all video surveillance today is deleted before it’s even seen by anyone. Some use this as a point to ask: Why should I switch?

If you’re looking to do more with live or stored video, IP video is a marked improvement over analog. With the adoption of HDTV and megapixel cameras, greater levels of detail can be achieved in a captured image. In essence, what’s gained in the banking segment is the ability to have more pixels on target that can be analyzed for incident investigations where the smallest of details are used by law enforcement. The ability to digitally zoom in and maintain a greater level of clarity on a teller line for improved facial recognition is only one of the immediate advantages of IP video.

Banks will also gain the ability to take full advantage of video analytics, which can provide better use of the video being captured. With the adoption of the ONVIF IP video standard, overall system integration capabilities are greatly improved allowing for multiple systems to seamlessly work together to enhance the security of retail banking centers, mission critical data centers and card processing facilities.

Another “difference” isn’t one that you can see. One of the major challenges for banking security managers is the cost and demand of site visits to conduct system upgrades. This not only requires the cost of sending a technician out to visit each site, it takes tremendous coordination and can sometimes impact standard business operations since DVRs are normally located in secure locations that require someone to provide access. Open standards make it easier to keep end devices up-to-date with remote firmware upgrades pushed out to the edge device as well as the ability to integrate with a wider array of software solutions. Video solutions of the future will not only meet current physical security needs but provide opportunities for overall operational enhancements.

Security needs of tomorrow: It’s IP

With technological innovations continuing to move forward at a faster pace than ever, reality is making IP video surveillance solutions the only viable alternative for meeting today’s and tomorrow’s security demands. Open standards, edge storage, encoders and other cost effective migration options are making it easy for banks and financial institutions to move seamlessly into market-leading technology – but both physical security and IT departments need to be on the same page. Develop a strategy that’s specific to the organization’s need and direction, and examine ways IP video can improve operations and security.