Getting a Great Deal

Credit counts in a balanced portfolio

- By Robert Ogle

- Nov 01, 2015

Your sales rep knocks on the door of

a nice home in an upscale suburban

neighborhood. There’s an expensive

car in the driveway, the landscaping is

immaculate, and it looks like it could be in the

middle of a city park.

It seems like a good place to make a sale, and

there’s no doubt that the rep has to give it a shot.

But keep in mind that appearances aren’t everything:

Not everyone who has a nice home and a

luxury car in an upscale neighborhood can actually

afford it.

Most dealers know that it’s crucial to run a

credit report before signing up a new account.

But it’s also worth remembering that it’s not a

minor detail, and even a borderline credit record

may have long-term repercussions.

That doesn’t mean you have to ignore every

potential customer with a less-than-stellar credit

report. But to create a successful, sustainable

portfolio with dependable RMR, you can’t afford

to throw too many into the mix.

Understanding FICO

Start by making sure your sales reps understand

what a FICO score is, how it works, and why it’s

important. Virtually every consumer has heard

the term, but very few can actually tell you what

it is.

FICO isn’t a credit reporting firm. It’s actually

a software development company that created

a formula for measuring consumer credit risk.

The first FICO algorithm appeared in 1987, and

it’s currently used more than 10 billion times a

year to predict which consumers are most likely

to be favorable credit risks. There are three major

sources for FICO scores—TransUnion, Equifax

and Experian—though there generally isn’t a great

degree of variation between the three providers.

The algorithm is simply a way of using numbers

to determine lending risks, rather than just

a hunch or a gut feeling. The exact formula has

never been revealed, but it’s generally acknowledged

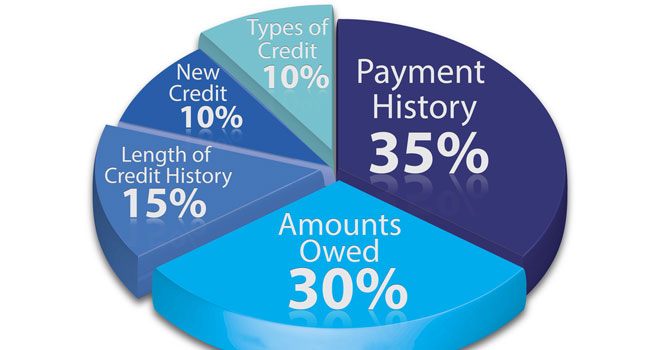

that 35 percent of the score is determined

by payment history (paying on time, repossessions,

liens, and so on), while 30 percent is determined

by debt burden (how much debt a consumer

has).

That means as much as 65 percent of what

makes up a FICO score is directly related to the

services you offer. Does the customer have high

potential for slow-pay or no-pay? And does the

customer already have so much debt that adding

a home security contract will just add more straw

to the camel’s back?

There are actually several different types of

FICO scores, depending on whether a person is applying

for a bankcard, installment loan, auto loan or just generic (or classic) financing.

The generic score has a range between

300 and 850; the higher the

number, the lower the risk.

Risky Business

Barbara Holliday, senior director

of Dealer Services for Monitronics,

says that credit score is the best

indicator for determining the likelihood

of timely customer payments

and contract renewals. Monitronics

stresses to companies in its dealer

network that roughly 1 in 4 customers

with credit scores between

600 and 625 will default on their

payments, and that many of these

customers will fail to pay within the

first year.

“Monitronics places a great deal

of emphasis on consumer credit

scores,” she said. “We help our dealers

by giving them access to online

tools that provide them with the average

score of their customer base,

and the percentage of their customers

by credit range.” Armed with

this knowledge, she said, dealers

can make informed decisions about

how to structure their portfolio on

an ongoing basis.

“Low credit scores are risky

business,” Holliday said. “When the

ratio of customers in the 600 to 650

range and the 700-plus range are off

balance, even the best companies

can’t succeed.”

Careful Consideration

Not all low credit scores are automatically

out of the picture, but

keep a close eye on how they fit

into your overall portfolio. If you

notice that sales reps are bringing

in customers with FICO scores

that are consistently in the low- to

mid-600s, you run the risk of being

weighted too heavily to the negative

side. As those customers default,

you’ll be forced to scramble for replacements.

Make sure low scores constitute

a relatively low portion of your

portfolio, and if you do decide to

overrule a FICO score, try to build

in ways of protecting yourself in

case of default. For example, ask for

more money up front, or put the

customer on an autopay plan that

takes the monthly payment directly

from their checking account, and

not their credit card.

“Once you recognize the risk

and lack of value of low credit

score customers, you can make

proactive changes in your marketing,

sales approach and approval

processes that will approve your

bottom line,” Holliday said. “There

are many creditworthy customers

in the marketplace, and when you

walk away from a low-score account,

you strengthen the viability

of your company.”

In other words, sometimes the

best customers are the ones you

don’t sign up.

This article originally appeared in the November 2015 issue of Security Today.