Going To Market

- By Bart Didden

- Mar 01, 2017

Back in the day when the security industry was still maturing,

the typical sales channel for the manufacturer consisted

of a rep organization with assigned territories and

dealers in the region, national account partners, distribution

organizations and occasionally a buying club.

THE WAY IT WAS

The small reseller or alarm dealer could usually only purchase from

the distributor or through the buying club and neither choice gained

them any benefit from being loyal to one brand over another. Product

training, technical support, marketing materials and so on were

provided by the supplier, with some organizations significantly better

than others. If a dealer or installer wanted to improve their knowledge

of a product or learn about new technology, the obligation was

on them to pay for participating in a training session at a manufacturer’s

road show—providing of course one was held in their region.

Leads were usually distributed by the manufacturer to the rep

organization and the small dealer or installer seldom, if ever, received

any leads. Other manufacturer perks such as co-op funds,

dealer trips and so on similarly were never pushed through to this

segment of the sales channel.

A CHANGING MARKETPLACE

As the industry matured, security and surveillance products changed.

Technologies became more sophisticated to meet demands of a

changing market; pan/tilt units with timed rotation were developed

to provide better coverage of an area with fewer cameras; monitors

with a built-in four camera switcher developed; tube cameras

changed over to chips and the notion of a digital system was on the

radar with the first DVRs.

These changes had a significant impact on market growth. For example,

over the last five years the market has grown by a compound

annual growth rate of 8.2 percent according to Memoori’s 2016 Annual

Report. A robust market also attracted new players from Asia

with lower cost goods and a surge of mergers and acquisitions, including

some from outside the industry, additionally helped drive

growth and bring attention to the industry.

Without a doubt, the increasing demand over the years for security

and video surveillance solutions have presented a solid opportunity for

the small dealer/alarm installer to expand their business models and

revenue prospects. The attraction however was not lost on those who

quickly came to market with a do-it-yourself surveillance solution.

These systems were sold on-line or in box stores and created considerable

competition for the professional security dealer/ installer.

SALES CHANNEL EVOLUTION

With the adage “if you can’t beat them, join them,” in mind, a unique

sales channel was introduced to the marketplace in the spring of

2016. Launching under the brand name of Security Dealer Network

(SDN), the new business venture offers alarm dealers the opportunity

to become part of their sales network and receive recurring monthly

income by offering DragonFly Security System DIY video surveillance

and monitoring services to customers. There are no start-up

or recurring costs associated with joining SDN’s dealer network,

making this a no risk proposition for alarm dealers to expand their

business models and revenue potential. End-users make all purchases

and monitoring arrangements via a powerful on-line ecommerce

platform, and dealers have no direct interaction with customers other

than to drive them to the site.

Dealers are provided with individual websites which are built,

branded and targeted to consumers with DragonFly Security System’s

extensive marketing and messaging. Using SDN’s e-commerce

platform, consumers purchase video surveillance products directly

through the website. Orders are shipped for free directly to the consumer

and SDN provides the central station monitoring. Dealers promote

the product to their communities and receive RMR generated

by the consumers’ monthly monitoring fees.

The company’s web site features a state of the art responsive design

that makes it easy for alarm dealers to learn about and sign up.

The site walks prospective dealers through the product lineup and

answers questions about how the program works, plus it features

short videos that talk about DIY video surveillance and monitoring

in an informative and engaging way.

For consumers, DragonFly Security System is equally simple.

Cameras are wireless and battery-operated and can be placed virtually

anywhere inside or outside quickly and easily. Several different

systems and monitoring plans are available to suit users’ budgets and

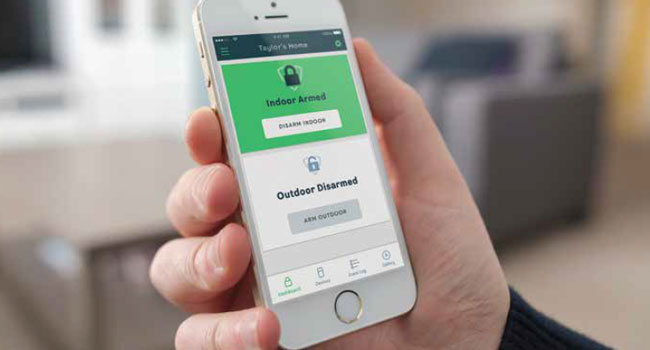

needs. The system can be viewed and multiple actions including police

dispatch can be taken through the DragonFly Security System

smart phone app.

This type of service offers something the consumer systems do

not—central station monitoring—which is a tremendous advantage

over systems like Nest. With DragonFly Security System, not only can

they view cameras at their homes and businesses through a smartphone

app, they can also have the confidence of knowing that their

cameras can be monitored by security professionals if they chose the

enhanced monitoring plan.

The evolved go-to-market strategy covers products and services

and is easy for partners and end users to understand, use and elicit

value. Choices are available for both partners and end users further

adding to the benefits of this new sales channel. In the end, the industry

as a whole benefits.

This article originally appeared in the March 2017 issue of Security Today.