The Heat Is On

For buyers and sellers, thermal sensors see beyond night vision

- By Christopher Lindenau

- Jul 01, 2013

As police surrounded the suspected Boston bomber hiding inside a

boat stored behind a Watertown, Mass., home last April, officers

with a thermal camera peered through the hull and tarp to watch

his every move. Unlike night vision goggles that detect visible light

energy, thermal imaging cameras see differences in surface temperature.

Thermal imaging “cameras” are more accurately called sensors.

As police surrounded the suspected Boston bomber hiding inside a

boat stored behind a Watertown, Mass., home last April, officers

with a thermal camera peered through the hull and tarp to watch

his every move. Unlike night vision goggles that detect visible light

energy, thermal imaging cameras see differences in surface temperature.

Thermal imaging “cameras” are more accurately called sensors.

The components include a display, detector, signal processing and optics. These

cameras operate by sensing infrared energy emitted from a target—the alleged

Boston bomber—and the target’s surroundings. The landscape seen through a

thermal camera is a collage of black-and-white images, with the ones giving off

the most heat seen as white.

Many in the security industry think of thermal cameras as something only useful

to special operations forces, firefighters and police. Many believe the cost of

this equipment is out of reach for practical applications. In fact, only 0.1 percent

of the commercial security market uses thermal imaging cameras today.

Prices Drop

However, over the past few years, as the wars in Iraq and Afghanistan have wound

down, post-war manufacturing capacity has exceeded military market demand,

which has caused the price of thermal imaging systems to drop. For example,

SP&T News reported that the volume of chips made for these cameras is causing

prices for standard resolution (640x480) thermal imaging cores with fixed lenses to

drop from $15,000 per unit to four figures. And, at ISC West 2013, some vendors

announced models for around $3,000.

However, when people see stories of thermal imaging as an aid to capturing fugitives

or as part of a commando raid, it reinforces the notion that the technology

is beyond the need of commercial security. Practically speaking, that sentiment is

wrong. Commercial security can benefit from not only adopting thermal imaging

but integrating it into an existing network surveillance system for use with enterprise

video management software.

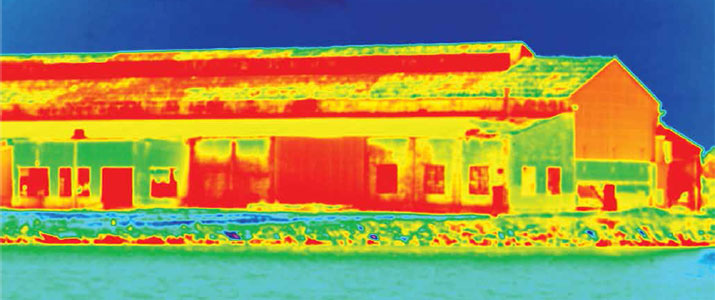

Imagine a warehouse that uses floodlights, HD visible cameras, PIR (motion)

sensors and ground loops along its perimeter to detect intruders at night. Perhaps

the warehouse owners employ security personnel to monitor these physical security

measures for intrusion, but these stop-gap measures are prone to produce

false alarms and have limited efficacy for night detection. Visible cameras can’t

spot trouble lurking under groundcover or beyond shadows. Motion detectors are

limited by range and obstacles in the path of detection, and ground loops are difficult

to install and can fail.

Complementing Visible Inspection and Cameras

In terms of cost versus efficacy, there is no comparable alternative to thermal imaging

for detection. At night, the next best alternative is not even close. Whole

fence lines, wide field areas, areas with architectural or foliage obstructions can

use thermal surveillance for intrusion detection. Thermal imaging offers a level of detection that complements visible inspection qualities and HD visible cameras during the day to provide

an overall better picture of a facility, a real value to

security personnel who cannot be everywhere at once.

In the commercial sector, power generation plants,

airport fence lines and data centers are using thermal

imaging to spot intruders. Due to the limitations of visible

camera technology, and labor and wiring costs to

install individual cameras—many customers are now

looking for cameras that employ both visible and thermal

cameras in the same system—a dual imaging approach.

In recent physical security upgrades at a major

metropolitan airport outside of New York City, dual

imaging was preferred over any other measure to detect

perimeter intrusion. When used with software analytics,

the result is both potent and cost effective.

The U.S. military first used thermal imaging cameras

for operations in the late 1960s. Like anything

the military procures, suppliers must meet exacting

standards. For example, thermal imaging systems for

military use must meet specifications for temperature

(from -58°F to 165°F), vibration (i.e., HumVee Standard)

and surge protection (i.e., Mil-STD-810G) beyond

what most commercial thermal imaging cameras

require. As commercial security professionals explore

a dual imaging approach, there will be increasing

pressure on commercial systems to meet militarygrade

standards because buyers will want to ensure

their investment lasts. There also will be pressure to

develop military-grade, network-ready thermal imaging

systems as the surveillance industry moves toward

the use of Ethernet switches and software, versus digital

recorders and hardware.

A Networked View of the World

Although analog camera systems still claim up to 80

percent of the industry’s installations, IP and networked

cameras are rapidly gaining ground. One

reason is the ease with which installers can add new

network cameras to an IP network. If, for example, an

integrator has to add more network cameras, then a

technician can run cable from the nearest switch. One

switch commonly supports up to 64 cameras, and can

be located within 100 meters of them, simultaneously

providing power through one cable.

By contrast, an analog camera installation may

require a technician to run video and power cables

from each new camera back to a digital video recorder

and a centrally-based power supply—a significant

increase in wire and installation cost.

With this advantage in mind, traditional IT-based

companies are increasingly entering the security industry

with new product offerings. such as software

video management platforms, powered PoE switches

and video recording solutions. This is driving corporate

IT departments to become part of the evaluation

process for the adoption of new products like

networked thermal imaging systems. Whereas with

analog systems the director of physical security chose

new surveillance technology on behalf of the company,

today network cameras systems empower the

CTO or IT director to be the key decision maker. And

that requires providers of security imaging systems to

show expertise in both optics and networking.

Adapting Thermal Imaging

to Fit Today’s Platform

Thermal imaging system suppliers must adapt their

technology to fit into an array of complex IT platforms,

and that concept is not always easy to grasp

for companies that specialize in developing camera

systems. Network camera makers have to ensure that

the software they sell with their cameras will integrate

with the network firewalls, software and hardware

that a corporate IT department has already put

in place. This is a different mindset. But, suppliers

adopting this point of view will help the customer

trying to coordinate a purchase between his security

department and IT group.

For example, modern enterprise software requires

standard protocols that enable a technician to integrate

a camera system with a network. The network

protocols are simply the mechanism by which systems,

servers and devices talk to one another. Common protocols

already exist for cameras, and these standards

are being adopted by thermal imaging systems, too.

One such protocol is ONVIF, which was created by

global industry group Open Network Video Interface

Forum. The standard aims to facilitate communication

between all physical IP-based security products.

The ONVIF protocol is already commercially available

on some network thermal cameras. Standard

protocols like ONVIF will allow manufacturers of

thermal cameras to integrate with the customer’s chosen

video management software.

Of course, analog thermal cameras also exist, and

integrators can encode these analog thermal imaging

systems to make them IP-ready, too. In fact, for the

majority of security appliances using analog technology,

most commercial encoders will accept an analog

thermal camera and create an IP format for it.

But let’s say a company has built its security system

on an analog footprint and wants to use a network

thermal camera. The integrator would recommend a

third-party encoder here, too. With the encoder, the

integrator can then migrate to an IP video stream.

The beauty of ONVIF lies in the fact that purchasing

an ONVIF-compliant encoder and integrating it

with an ONVIF-compliant camera provides interoperability.

In 2011, ONVIF developed a profile concept.

This profile simplifies the identification of interoperable

products, and it lets customers easily identify specific

features by profile.

“The primary benefit of our Profile concept is

knowing that when two products bear the Profile C

[access control] or G [video storage] mark, the same as

what is already available with Profile S [video streaming]

conformant products, they will work together,”

said Per Björkdahl, ONVIF chairman. “Rather than

trying to figure out whether one version of the ONVIF

specification is compatible with another, or which features of the product might interfere with interoperability,

seeing that mark ensures a successful interface.”

There is much to be excited about with network

appliances, especially thermal imaging systems. But

there is one major shortcoming. All of that compression

that is part of delivering a network image via

camera causes latency. The degree of latency may be a

matter of milliseconds, but it’s there. That said, there

are companies that have achieved a degree of latency

that is now less than 150 milliseconds. Companies

that know how to improve the compression algorithm

to decrease latency can overcome this shortcoming of

network appliances.

What’s Next for Commercial Security?

Today, thermal imaging systems are sold with a standard

resolution of 640x480, which makes 1,280x720p

the next likely thermal imaging system for commercial

applications. While these HD imaging systems are available,

they can cost upwards of $50,000 but expect to

see such imaging systems come down in price. Typically

you will see HD thermal imaging systems in the military,

aboard a tank for targeting enemy combatants.

The cost of these systems is in the production of

the lens, as well as the camera core, which processes

the image. While producing the core for an HD thermal

imaging camera can be expensive, the greater cost

is the lens. To see the transfer of infrared light emitted

from an object, lens manufacturers have to use a

significant refinement process. These lenses range in

price from fixed-lens configurations, with a fixed focal

plane, to continuous zoom lens. And the price point

jumps by a factor of four from fixed lenses to continuous

zoom lenses.

Whenever manufacturers increase the resolution

of the chip inside a camera, the price of the camera

core will increase by a factor of five. Consequently,

the increased size of the imager and the lens will also

mean a price increase by a factor of five.

Beyond 720p is 1080p. A 1080p thermal imaging

system for commercial use is still something we have

yet to see. The size of the imager alone would be large

and the lens would be comparable in diameter to a

basketball, making the system too big for commercial

applications.

With the advent of HD thermal technology for

commercial applications, imaging-system makers

will give customers a way to not only detect, but also

identify threats. The distinction is important, and it’s

based on the Johnson criteria. The Johnson criteria

give us a way to understand the performance of visual

devices, such as imaging systems. Simply put, criteria

defines “detection” as observing the presence of an

object; whereas “identification” is not only spotting a

car but also seeing that it’s a VW Bug.

Thermal imaging technology offers a level of detection

and identification that will

complement your existing surveillance

system when the heat is on.

This article originally appeared in the July 2013 issue of Security Today.