The total value of world production of security products at factory prices was $23.4 billion in 2013, predicts Memoori, who has just published a new definitive resource for security market research & investment analysis.

If we compare these figures with 2008, the world market has grown at a rate of around 4.5% over the last 5 years, which is very good given the poor economic trading conditions that have prevailed for much of that time.

The 2 major drivers have been a 12% aggregate growth in video surveillance and higher levels of demand in Asia, which has increased its share to over 39% for all physical security systems. Growth has been much more modest in North America and Western Europe; currently, the developed markets of Europe, Scandinavia and North America take some 47% of the value of the business, 2% down on last year.

In Europe, public sector budgets will be trimmed to help pay off sovereign debt. This will result in an almost certain decline in demand in the public sector across several EU countries. However, the fast growing markets of Asia and other BRIC countries will continue to expand.

The security industry is in a much healthier state with a product portfolio that can deliver more attractive opportunities for clients to improve security, and at the same time, profit from it. In fact, Memoori is forecasting a growth rate of 8% over the next 5 year period with the market reaching $32.2 billion by 2017. This could be considered optimistic, but there is an enormous latent demand waiting to be exploited in the emerging markets of the world.

Emerging Markets

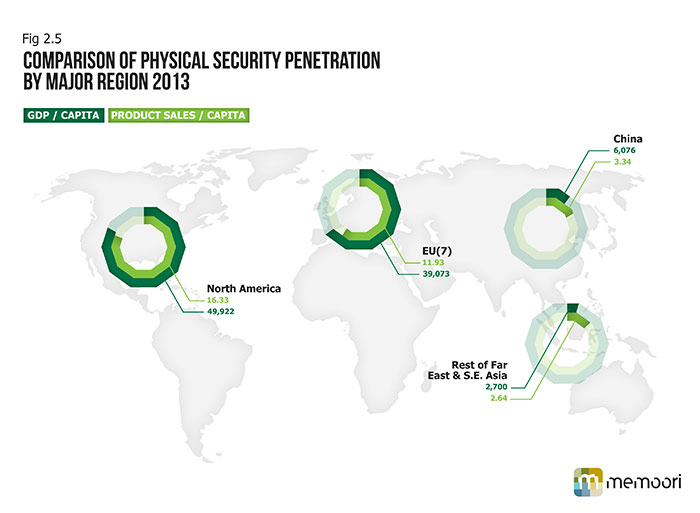

The measure of penetration of security products in any country is an important factor to establish because it sets a benchmark for the latent potential that is available. This has a major bearing on future growth. The diagram below shows 4 major regions in the world compared on a matrix of physical security products per capita against GDP per capita estimated for 2012.

In China, sales per capita were $3.34 in 2013, showing that the potential for future growth is significant. This market has forged ahead at the highest rates of growth recorded in our industry and its aggregate growth over the last 5 years has not slowed down, however. Despite the fact that its penetration has increased by almost 60% during this time, it is still only one sixth of North America.

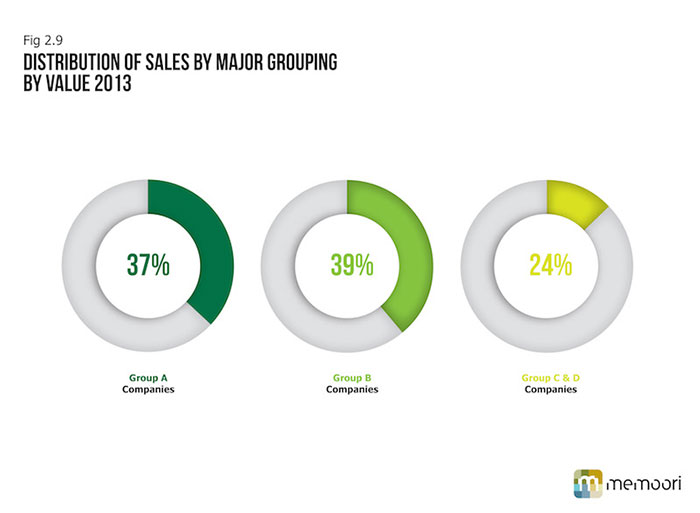

As part of the research Memoori categorizes the market into 3 main groupings:

- Category A includes major global players having sales of over $1 billion in security systems;

- Category B includes companies having sales of over $100 million but less than $1 billion; and

- Category C includes companies that have sales of over $1m but less than $100m.

In 2012 and 2013, the structure of the business seems to have changed, primarily by Category B companies’ rapid growth through innovative IP networked products delivered through organic growth. Category A companies’ share of the product market has declined, and they have failed to correct this through their normal process of growth through acquisition.

Are major conglomerates losing interest in the security business? Well, most have made major acquisitions in their other businesses, and they are cash rich. Looking forward, they are in a strong position to access the future growth, most of which will come from Asia and the emerging markets, but only if they can offer leading-edge technology products.

We believe that in the relative short term of the next 2 years, they will need to take action either to acquire leading-edge technology companies or sell their products business and concentrate on their systems business. Indeed, this is already happening. Ingersoll Rand announced plans earlier this year to spin off its security products business. The new company will be called Allegion and will have revenues of over $2 billion.

Throughout the last 3 years, successful security companies have delivered annual growth well into double figures, but this has required them to make some fundamental changes to established business practices.

Continued growth should be built on the foundation that through disruptive IP technologies and innovative business models, we can move clients’ security operations from a cost center to a cash generator, while converging with other services in the business enterprise.

Acclimatizing to this rapidly changing business environment, reshaped by technology and new competitors from outside the business, will require a clear vision of future business opportunities and skillful implementation of the appropriate strategies.